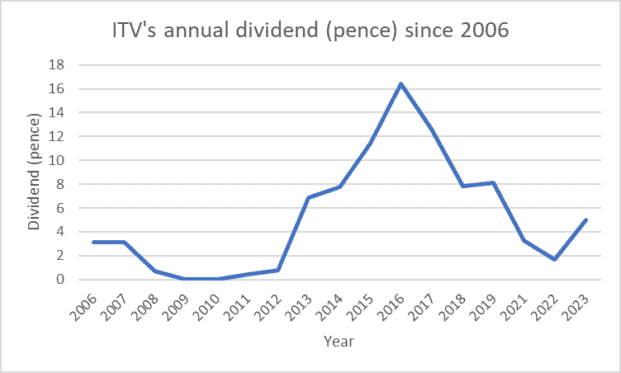

This dividend stock has a wildly unstable payout record. However, right now it boasts an index-beating 8.4% yield. Could ITV (LSE:ITV) be the undervalued gem dividend hunters have been searching for?

ITV, a FTSE 250 stock, has navigated its way impressively through the pandemic-induced market turbulence. This period saw a significant impact on its share price and dividends. However, since 2021, there’s been a noticeable effort to boost its dividend payments.

Source: DividendMax

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

What if the company could return to its all-time-high dividend payment of 16p? That would mean investors getting in at the current price of 58p would end up enjoying a staggering 28% yield on their investment. This scenario is not as far-fetched as it might seem, given the company’s strategic advancements and financial performance in challenging times.

Tuning in for revenue growth

ITV’s interim results for the period ending 30 June 2023 highlighted the strategic progress the company has made. Despite a tough advertising market, its revenues increased by 8%, reaching £1bn in the first half for the first time. Digital revenue soared by 24%, driven by the success of ITVX. This performance is particularly impressive, considering the overall decline in traditional advertising revenues. It seems to underscore ITV’s successful pivot towards digital and diversified content creation.

The pandemic era posed significant challenges. ITV made the tough decision in 2020 to cut programme spending and dividends to save over £300m. Yet this move was part of a broader strategy to preserve cash and ensure the company’s long-term sustainability. Now the world has emerged from the pandemic’s shadow, ITV’s strategic investments in digital transformation and content diversification have begun to pay off. All this could be setting the stage for a dividend recovery.

I’m an investor, get me in here!

Looking ahead, ITV remains optimistic. The company expects a more encouraging future as it capitalises on large streaming and traditional TV audiences for upcoming events like the Women’s World Cup and the Rugby World Cup. With a commitment to paying a total dividend of at least 5p for the full year (expected to grow over time), ITV is signalling confidence in its financial health and strategic direction.

For me, the narrative is clear. ITV represents a potentially undervalued opportunity with a high yield in the current market. Of course, there’s a real threat posed by the fiercely competitive nature of the entertainment market. The streaming segment is spearheaded by seemingly unstoppable US tech companies like Netflix, Amazon, and Apple. All three of these giants are making a powerful play for eyeballs and advertisers.

Still, ITV’s ability to navigate through challenging times, coupled with strategic investments in digital and content diversification, positions it well for future growth. In addition, the stock looks cheap trading at a price-to-earnings (P/E) ratio of just 8.

While the past dividend record has been unstable, the company’s recovery trajectory and ambitious plans could make it a fantastic addition to my dividend portfolio. I plan to add some shares when I next have spare cash.